Step into top operational roles in India’s leading banks — with job-ready skills, practical exposure, and expert mentorship.

Must be between 21-28 years at the time of enrollment.

CIBIL Score (at least 700) or 1 (Further in no case CIBIL should be in High-Risk Category)

graduate or postgraduates with min 50% marks of any stream.

Maximum 2-year gap after the last educational qualification.

Candidates with prior work experience are also eligible.

Manage branch cash—deposits, withdrawals, cheque processing. Balance the cash drawer daily, maintain records. Requires numerical accuracy, responsibility, and customer sales/service orientation. Ideal first step into branch operations.

job openings

Average Salary

Our 100-day flagship program is developed with direct input from banking veterans to match the real demands of operational roles.

Training that mirrors real-world operations, from cash handling to complaint resolution. Students gain practical experience before stepping into a bank.

All classes are 100% live and led by former bankers with 10–30 years of BFSI experience. Learners benefit from real-time doubt resolution, case-based teaching, and deep industry insights.

Our in-house Placement Cell provides resume guidance, aptitude training, mock interviews, and access to 5+ exclusive placement drives with top banks and NBFCs.

Our graduates work with HDFC Bank, Kotak Mahindra Bank, Axis Bank, IDFC First Bank, Bandhan Bank and many more. We also offer post-placement mentoring and career progression support to help you grow after landing your first job.

Our program is priced to be accessible for fresh graduates and government exam aspirants, with flexible payment plans and EMI options—delivering exceptional ROI for your career.

Introduction to Banking

Our trainers at IBSC are experts with real world experience. They make learning easy and interesting for all students.

Our trainers at IBSC are experts with real world experience. They make learning easy and interesting for all students.

Founder | 24+ years

Retail Banking – Assets and Liabilities

Ex-Vice President,

Kotak Mahindra Bank Ltd.

Co-Founder | 26+ years

TechnoBanker, Learning & Development

Ex-Vice President,

HDFC Bank Ltd.

Banking Trainer | 25+ years

Retail Branch Banking

Ex-Vice President,

Axis Bank Ltd.

Banking Trainer | 10+ years

Retail Branch Banking

Ex-Manager,

The Karur Vysya Bank

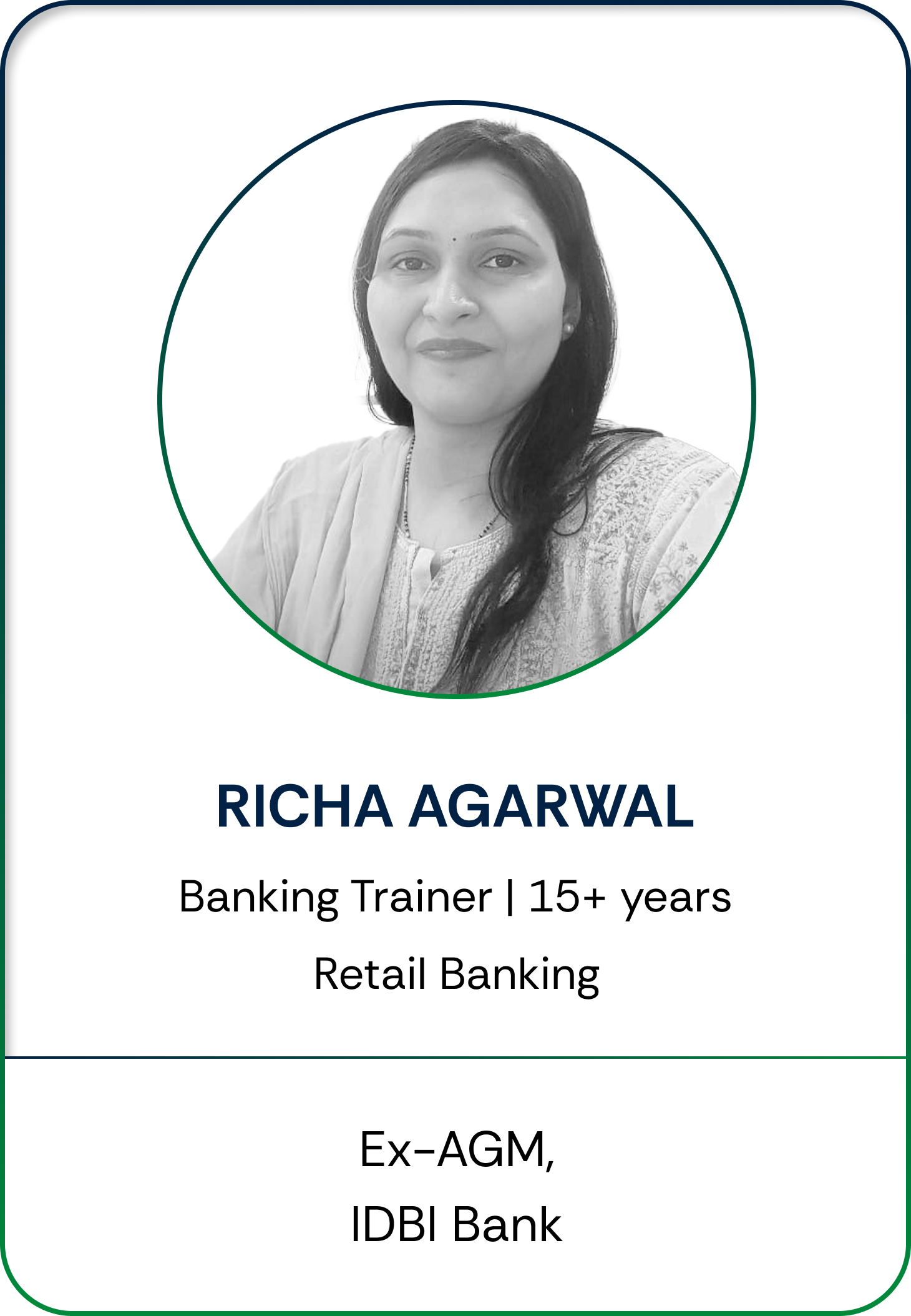

Banking Trainer | 15+ years

Retail Banking

Ex-AGM,

IDBI Bank

Banking Trainer | 18+ years

Retail Banking Operations

Ex-Manager,

Kotak Mahindra Bank Ltd.

Banking Trainer, 26+ years

Retail Branch Banking

Ex-Assistant Vice President,

HDFC Bank Ltd.

Banking Trainer | 23+ years

Retail Banking- Liabilities and Sales

Ex-Senior Vice President

,

Axis Bank Ltd.

Hear it From Them

Ambitious People ❤️ IBSC

Bridge the gap between education and employment with IBSC!

Yes! Upon successful completion of our Professional Certificate Program in Retail Banking, you will receive a prestigious certification from IBSC, in association with BFSI-SSC (BFSI- Sector Skills Council).

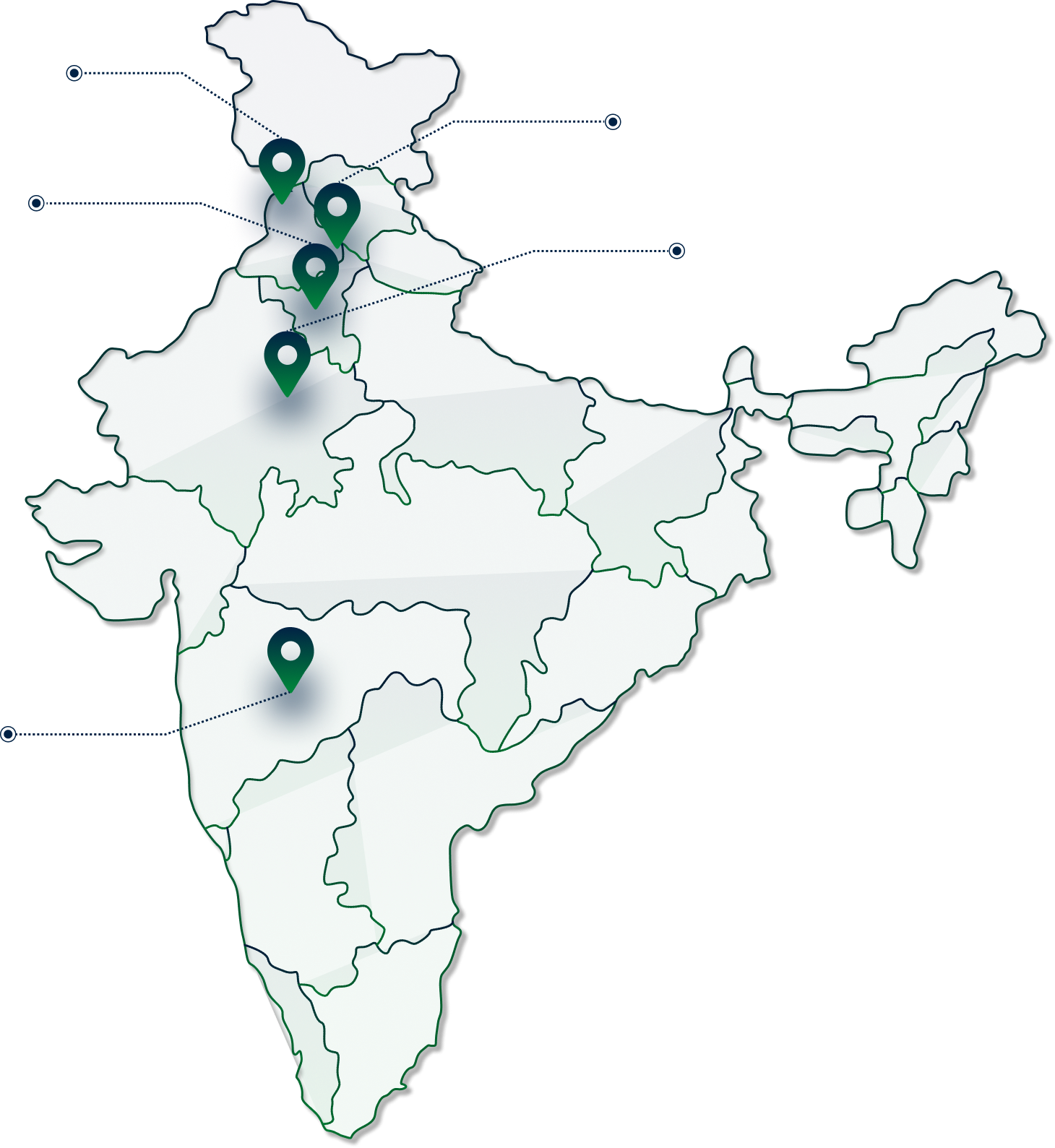

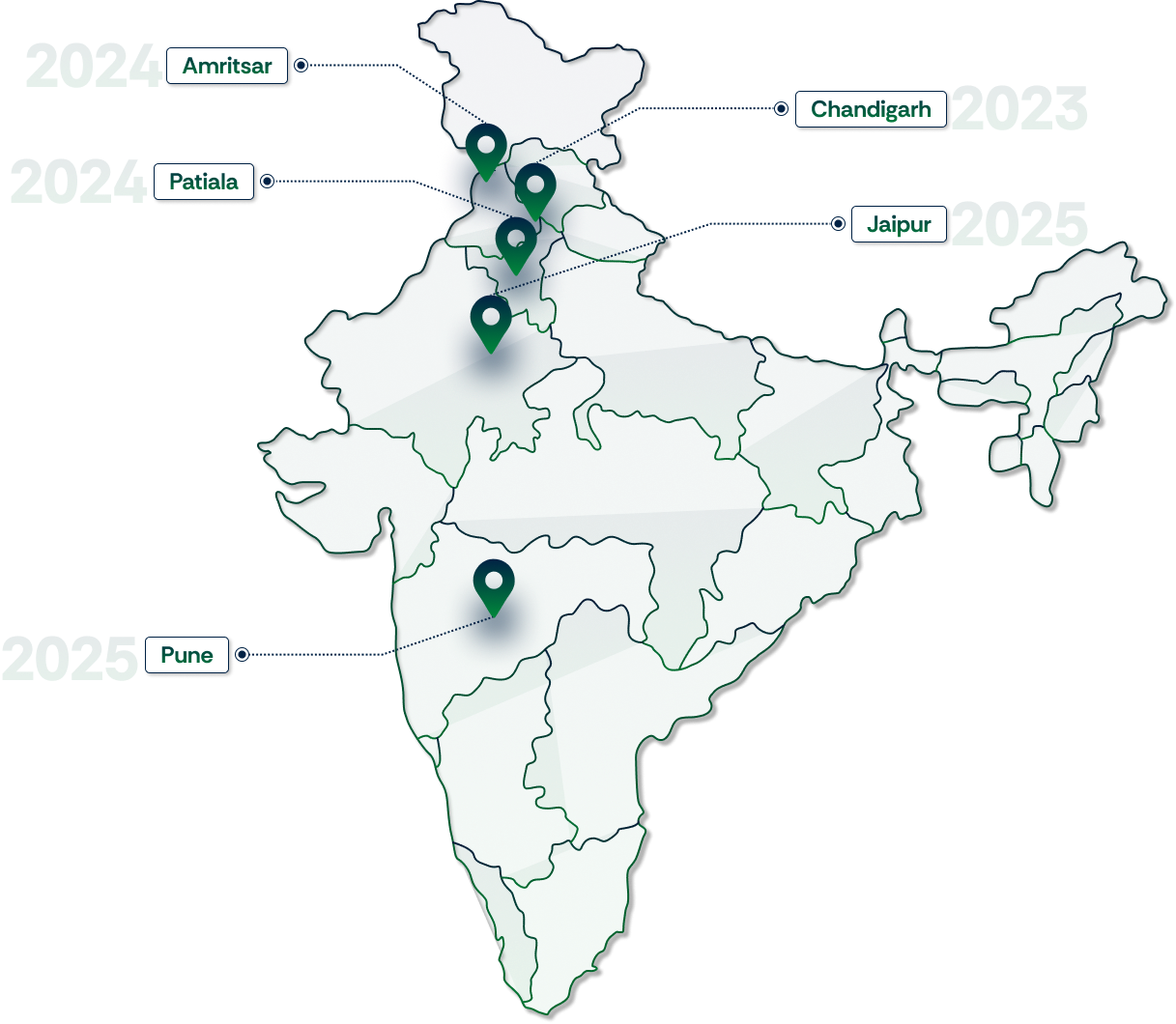

IBSC’s strong presence across cities ensures accessible, industry-relevant banking education. Our

network bridges skill gaps and boosts career opportunities for aspiring professionals nationwide.

IBSC’s strong presence across cities ensures accessible, industry-relevant banking education. Our

network bridges skill gaps and boosts career opportunities for aspiring professionals nationwide.

IBSC’s banking and finance courses are open to graduates, job seekers, and working professionals looking to build or switch to a career in the Banking, Financial Services, and Insurance (BFSI) sector. Whether you’re a fresher, a government exam aspirant, or someone looking to upskill, our programs are designed to suit a variety of educational and career backgrounds

The course is delivered entirely online through live, interactive sessions.

You’ll need to provide identity proof, educational certificates, experience certificates – if applicable and any additional documents as required during admission process.

The admission process involves:

Yes, you will receive a certificate upon successful completion. IBSC is an authorized training partner of BFSI Sector Skills Council (NSDC initiative).

The course duration is 100 days. New topics begin every Monday.

Classes are conducted from 10: 30 AM to 12:30 PM for Morning Sessions and 7:30 PM to 9:30 PM for evening sessions, Monday to Friday.

Yes, financing is now available through zero-interest EMI options for up to 6 months. This makes it easier for students to pay in flexible installments without any additional cost. For details, please speak to our admissions counsellor.

Yes, IBSC provides comprehensive placement assistance to all its students. Upon completion of the training program, we offer five guaranteed interview scheduling with leading banks, NBFCs, and other BFSI companies.